At St. Joseph Healthcare, we greatly appreciate the generosity of all our donors, which is why we want to make it as convenient as possible. Discover all the ways you can give and decide which works best for you and your family.

St. Joseph Healthcare is a tax-exempt organization under Section 501(C)(3) of the Internal Revenue Code.

3 Ways to Make a Gift

Giving online is a secure and easy way to make a gift. We accept Visa, MasterCard and American Express. You can make a one-time gift or a recurring gift (monthly). Click here to give online.

To give by mail, please send your donation to: St. Joseph Healthcare Foundation, PO Box 1638, Bangor, ME 04402-1638. Cash and checks are accepted. Please make checks payable to St. Joseph Healthcare Foundation.

Phone

Please call (207) 907-1740. to make your donation over the phone using your credit card between the hours of 8 a.m. and 5 p.m. Eastern Time

Ways to Give

Each year, loyal donors like you make donations to support the hospital program or service that is most need. Learn More >

By including a bequest in your will or including us as a beneficiary of a retirement account, life insurance policy or annuity contract, you can endow your annual gift for years to come. Similar to your annual gift, your bequest-endowed gift will join with others in the St. Joseph Healthcare Foundation Endowment Fund to support the general operation of the hospital in perpetuity.

It’s easy to do, just designate “the St. Joseph Healthcare Foundation endowment general operating fund” as a beneficiary in your will or trust or designate the same as a beneficiary of your life insurance. Those who do so are recognized as a member of the Felician Society.

Consider Continuing Your Annual Support With a Bequest

| My Annual Gift | Bequest Amount to Endow Your Annual Gift |

| $25 | $625 |

| $50 | $2,360 |

| $100 | $2,500 |

| $250 | $6,250 |

| $500 | $12,500 |

| $1,000 | $25,000 |

| $2,500 | $62,500 |

| $5,000 | $125,000 |

| $10,000 | $250,000 |

Want to support a specific program?

Independent named endowments in support of specific programs can be created with a minimum commitment of $25,000.

Many employers match their employees’ charitable giving. Please ask your Human Resource department for the appropriate matching gift form to increase the impact of your contribution. Make a gift >

One sentence in your will can make a lifetime of difference. Please use this sample language as a framework for shaping your bequest with your advisors. “I give and bequeath to St. Joseph Healthcare Foundation located at 106 Congress Street, Bangor, ME 04402 ___ percent; OR the sum of $______ from my estate; OR all the rest, residue or remainder of my estate. This gift may be used (where needed most or for XXX program/fund support.) We would be delighted to help you create a bequest for a purpose close to your heart. Please contact J. Bradford Coffey, Esq. at 207-907-3199 or brad_coffey@covenanthealth.net so that we can discuss how your bequest has the impact you wish. When you make a bequest, you will join the Felician Society

For many of us, the most significant gifts we’ll ever make are those given at the end of our lives. There are many charitable options to choose from, depending on your goals. Whether gift of life insurance, charitable gift annuity, or charitable trust, we are honored to help you meet your personal and philanthropic goals. Contact J. Bradford Coffey at 207.907.3199 or brad_coffey@covenanthealth.net for more information. When you make a planned gift, you will join the Felician Society

A gift of appreciated stock may offer you the opportunity to provide a more generous gift than an outright gift of cash and is a fantastic way to support patient care. When you donate appreciated stock you have owned for more than one year, you can enjoy greater tax savings from giving such property than if you were to donate an equal amount in cash. To receive such benefits, you must transfer the securities to St. Joseph Healthcare rather than selling them and then donating the proceeds. Instructions for giving stock >

Tribute gifts, a special and personal way to remember or honor a loved one or to recognize an employee, are always accepted and received with gratitude. If your donation exceeds $1,000, your loved one’s name will be added to our Memorial Wall near the elevators. Give now >

Giving through your donor advised fund is easy! We’d love to say thank you for your gift, please include your contact information with your gift.

Donors aged 70.5 and older can make a qualified charitable distribution from their IRA. If you are of an age to have an annual required minimum distribution you can make a gift of up to $100,000 to meet your minimum distribution requirements which reduces your income by the amount donated. This form of giving is also another way you may be able to make a greater impact on the lives of those who will benefit from your generosity! Request a IRA-QCD Letter > Read our FAQ >

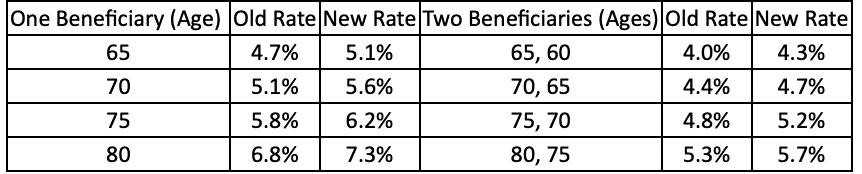

For the first time in more than six years, the American Council on Gift Annuities has increased its suggested rates. St. Joseph Healthcare is now offering these new, higher rates.

Here’s an example of a CGA: 75-year-old couple John and Sue would like to diversify their estate plan, as well as give back to their community. They establish a $100,000 charitable gift annuity to St. Joseph Healthcare. At a rate of 5.5%, they are guaranteed a $5,500 payment each year, for the remainder of their lives. After John and Sue both pass away the remaining amount will be used to support St. Joseph Healthcare’s vital work.

The typical charitable gift annuity donor:

- Is 65+ years old

- Would like additional income

- Likes the idea of a fixed lifetime payment

- Has assets that generate little income, such as interest or dividends

- Has assets with a low tax cost basis

Contact Brad Coffey at (207) 907-1740 or brad_coffey@covenanthealth.net for more information.

Unencumbered real estate that is readily salable in the marketplace can be a wonderful gift. Upon notification of a potential gift of real estate, we will work with you to evaluate the making/accepting of the gift and approach that are in the best interest of you and St. Joseph Healthcare.